Isosceles has worked with investor-backed businesses for over 20 years, and many of our clients have benefitted from programmes backed by the British Business Bank but were unaware of the Bank’s involvement.

We were, therefore, delighted to welcome Tracy Sherratt and Dr Sophie Dale-Black from the British Business Bank to our recent iFD Community event to explain the work of the UK’s most influential business bank and introduce us to some of the funding options available to our clients.

Related Article | Flags for investment – is your business ready to fundraise?

Who is the British Business Bank?

The British Business Bank is the UK’s economic development bank; although 100% owned by HM Government, it is operationally independent.

It supports more than 96,000 businesses with over £12.4bn of investment through its core programmes.

The Bank delivers a wide range of programmes and different finance options for SMEs designed to address a business finance market failure and help improve access to finance for smaller businesses.

They do not lend or invest directly; they deliver funding and investment through 200 delivery partners across the UK. These partners range from the largest banks to small venture capital providers and innovative new players in the market, such as peer-to-peer lenders.

The Bank is dedicated to helping UK small businesses survive, prosper and grow

The Bank has four strategic objectives:

Driving sustainable growth: Ensuring smaller businesses can access the finance they need to start, survive and grow.

Backing innovation: Ensuring innovative businesses, such as technology, life sciences and similar capital-intensive growth sectors, can access the right capital to start and scale.

Unlocking potential: Unlocking growth by ensuring entrepreneurs can access the finance they need regardless of their geographical location, gender and ethnicity. Bank research shows that female-led and ethnic-minority-led businesses face supply and demand-side barriers in the debt and equity sectors.

Building the modern, green economy: Financing groundbreaking solutions to climate change and helping smaller businesses transition to net zero so they can thrive in a green future.

The Bank has an extensive portfolio of financing options for smaller businesses

Related Article | What are the different stages of funding for a business?

Which fund is right for your business will depend on what type of funding you are looking for – start-up, scale-up or stay-ahead funding.

Debt Solutions

Debt finance is the more widely used form of raising finance. It’s where a business borrows money and pays it back with interest over an agreed period. The Bank’s debt products include:

Start-up Loans: Government-backed unsecured personal loans of up to £25K and free mentoring to new entrepreneurs who would not typically qualify for loans from commercial lenders.

Nations and Regions Investment Funds: Nation-focused and regional-focused funds to support smaller businesses. For example, the £660m Northern Powerhouse Investment Fund to support further expansion into the North East of England from the original geography of the first fund and the £150m Investment Fund for Scotland.

Related Article | Isosceles opens Sheffield office with Northern Powerhouse

Recovery Loan Scheme (RLS): With this scheme, the British Business Bank can lend to firms on better terms than would otherwise be available. The Spring Budget announced an extension to this programme, to be renamed the Growth Guarantee Scheme.

ENABLE Funding and Guarantees: Aimed at improving asset and lease finance provision. It is designed to encourage banks and other lenders to increase their lending to smaller firms.

Equity Solutions

Equity finance takes longer to receive and is more suited to businesses wanting to fund growth. The business must sell a stake in the company to an investor or group of investors in return for finance. The Bank’s equity products include:

Regional Angels Programme: This programme invests alongside angel investors into smaller businesses across the UK. It focuses on reducing regional imbalances in access to seed equity for smaller UK businesses.

Enterprise Capital Funds: The British Business Bank is the UK’s largest domestic backer of VC funds. This fund seeks to address the UK equity gap for early-stage financing of high-growth companies by providing a super-charged return to private investors.

British Patient Capital: British Patient Capital (BPC) is the UK’s largest domestic investor in venture and venture growth opportunities, with more than £3bn of assets under management, and it is a subsidiary of the British Business Bank. It was created to deal with the gap in the finance market; they focus on large fundraises with rapidly scaling companies, and it is the most prolific life sciences investor.

The Bank also helps businesses acquire substantial levels of investment to drive innovation.

The Future Fund: Breakthrough programme is a highly targeted programme (delivered through British Patient Capital) designed to address the equity funding gap for growth-stage R&D companies. It began as a £375m programme, with an additional £50m allocated in a recent Government announcement.

- An investor-led programme supporting best-in-class fund managers

- Encourages private investors to co-invest in high-growth, innovative companies

- It focuses on R&D-intensive companies operating in breakthrough technology sectors (such as quantum, clean tech and life sciences)

- The minimum total investment round size is £30m

- Companies must be in scale-up mode and have raised at least £5m in previous funding rounds

There’s money available – so what’s the problem?

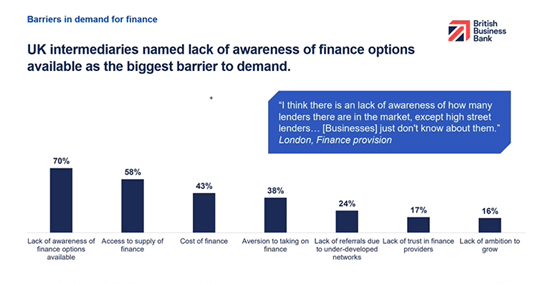

The investment landscape changed significantly in 2023 and into 2024, with many companies finding it very difficult to obtain funding and many failing to succeed. It was very reassuring to hear the British Business Bank confirm the various programmes it has available. The problem is that whilst plenty of money is available, the Bank’s research has identified some significant barriers to demand.

The top three most significant barriers to obtaining investment are:

- Lack of awareness of finance options available

- Access to supply of finance

- The cost of finance

The Bank has produced a detailed guide to help small businesses overcome some of these barriers (see link below). This guide is designed to help small businesses make an informed choice about accessing the right type of finance for your business. In this guide, they’ve highlighted the seven most common challenges your business might face and the types of finance that could help you meet them.

Related Article | Making Business Finance Work for You (British Business Bank publication)

By preparing for investment, companies can maximise the likelihood of a successful funding round

Before approaching investors, you must prepare the business for this complex, intensive, time-consuming process and engage specialist support.

Please get in touch. We can help.

Author’s Biography

Written by Karen Stocker, Digital Marketing Professional who has headed up Isosceles’ marketing since 2004. This article was written with contributions from Sophie Dale-Black, Director of the British Business Bank.

Connect with Karen on LinkedIn

(Image Source: Shutterstock)