Follow us on LinkedIn and Twitter.

Written by Joao Futscher, Fractional CFO

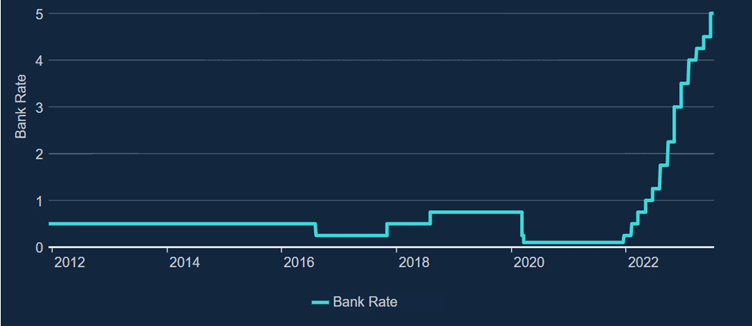

In December 2023, the Monetary Policy Committee (MPC) at the Bank of England voted by a majority of 6-3 to maintain Bank Rate at 5.25%.

After ten years below 1%, since 2022, in efforts to tackle inflation levels only seen in the 1980s, the Bank rate has soared, and some analysts predict that it could get higher.

(Source: Bank of England)

Navigating UK interest rates might lead companies to grapple with serious negative consequences, such as:

Increased borrowing costs

Raising capital through loans or bonds will result in increased interest expenses, pressuring their bottom line and reducing the funds available for capital and operational expenses.

Reduced consumer spending

Higher borrowing costs for individuals, e.g., mortgages or car loans, can lead consumers to reduce their discretionary spending, which can negatively affect companies, particularly those seen as non-essential.

Valuation and investment challenges

Rising interest rates tend to negatively affect the valuation of companies, lower present value of future cash flows and higher opportunity cost for investors, limiting companies’ ability to raise funds.

Taking proactive measures to mitigate negative consequences of rising UK interest rates

Specialist fractional CFO services providers, like iFD, can help businesses take proactive measures and implement proven financial strategies to mitigate the negative consequences of rising interest rates and position it for sustainable growth, such as:

- Designing a financial and strategic plan by creating different scenarios to understand the other challenges, constraints, and opportunities.

- Optimising pricing to create more value so your company can capture it, including creating recurring revenues to decrease uncertainty and resist the fluctuations associated with economic cycles.

- Cash flow optimisation through the prioritisation of different projects and cost controls to induce savings.

Related article | How to manage cashflow during economic turbulence

Visit our website to learn more about how we support our clients.

Author’s Biography

Written by Joao Futscher, a fractional CFO and former Investment Banker and MBA specialising in growing companies from Series A to C. He has assisted many companies in the European and American continents through different growth stages.

(Image Source: Shutterstock)