The R&D tax incentives landscape has changed significantly for accounting periods beginning on or after 1 April 2024.

At a previous iFD Community event, we provided an update on the 2023 scheme changes and a view of the further changes proposed by HMRC for 2024 and beyond.

Following the Chancellor’s Autumn Statement on 22 November 2023, the government concluded its review of R&D tax reliefs with the announcement of the merged scheme.

The changes aim to streamline the process and enhance compliance. In this blog, we explore the key changes.

(Updated April 2024)

What are the latest changes to the R&D tax relief scheme?

There is currently one merged scheme for all companies. This aims to simplify the tax relief process and make it more consistent across different sizes of businesses.

Any size of company conducting qualifying R&D can claim under the merged scheme.

There is also an additional scheme with a more generous basis of calculation for only loss-making R&D-intensive SMEs.

However, the subcontracting treatment has significantly changed from the initial proposal outlined in early 2023.

There is now also a limit on third-party payees, meaning that only the claiming company can receive the cash. This alteration will target less reputable advisers.

Additionally, the R&D Review which has been ongoing for the past couple of years has closed.

The UK’s Research and Development (R&D) Tax Relief scheme was initially rolled out in early 2000. Companies that spend money developing new products, processes, or services are eligible for R&D tax relief. The scheme was established to encourage businesses operating in the UK to invest in innovation.

The R&D tax relief scheme is a valuable source of funding for growing tech companies. According to the National Statistics publication produced by HMRC, the provisional amount of total R&D relief support claimed in the tax year 2021 to 2022 was £7.6 billion.

Related article | R&D Tax Relief: Don’t miss out on this valuable source of funds

The ‘merged scheme’ is based on RDEC-like rules

Merging the schemes is a tax simplification, which includes an aligned set of qualifying rules and a more visible above-the-line credit.

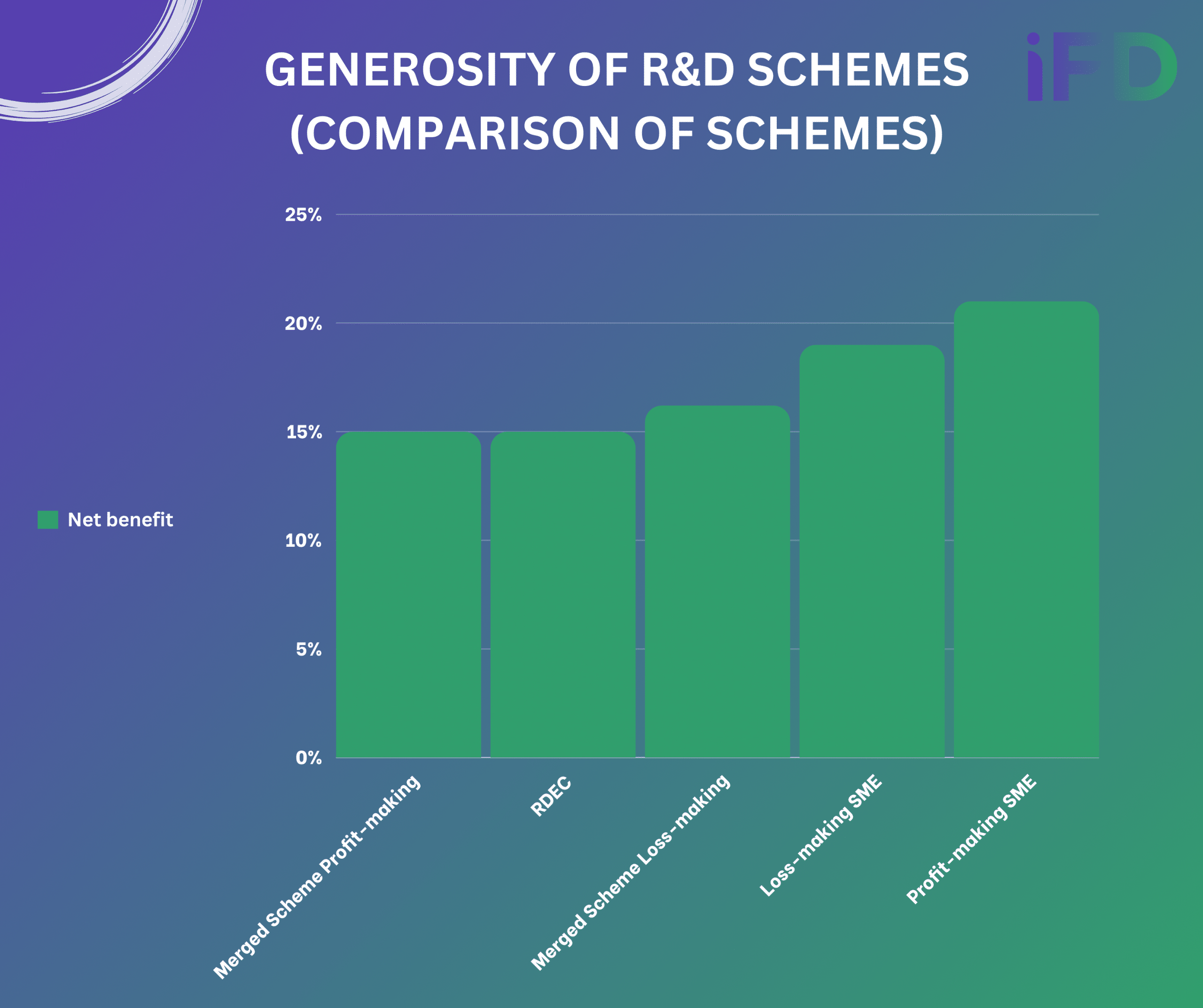

The scheme will offer a gross 20% credit of qualifying expenditure which comes in as taxable income in the calculation. This brings a net 15% benefit for profitmaking companies.

However, lossmaking companies will only be subject to a 19% withholding amount, not 25% so they will receive a larger benefit of 16.2%.

Historically, SMEs have been required to recognise their R&D relief ‘below the line’, impacting only their cash flow and tax charges. Under the merged scheme, the relief must be recognised in turnover and EBIT and will positively affect those KPIs.

Enhanced R&D intensive support

Enhanced R&D intensive support is calculated in the same way as the SME scheme before 1 April 2024, but with one notable change; the threshold to qualify as ‘R&D intensive’ has been reduced from 40% to 30% of total expenditure, making it more accessible for more SMEs to benefit from enhanced relief.

The same expenditure rules apply as for the merged scheme.

A one-year grace period will also allow companies that dip under the 30% qualifying R&D expenditure threshold to continue to receive relief for one year.

The initiative will function like the current SME tax relief scheme with a ‘below the line’ super-deduction and a payable credit based on surrenderable loss.

What changes came into effect during 2023?

The scheme has experienced various iterations over the years, but the most notable transformation took place in 2023:

- There was a rebalancing of the rates effective from 1 April. The SME rate is now around 20%, and for RDEC, it is 15%.

- There is now a requirement for advance notification for new claimants intending to claim within six months of the end of their accounting year.

- The online Additional Information Form was introduced. This online form is required for all claims made from 8 August 2023. Any company that fails to complete this form fully will see its claim removed from its tax return.

Qualifying expenditure in the ‘merged scheme’ broadly remains unchanged

The following areas will not change:

- The definition of R&D will remain unchanged.

- Categories of costs such as staffing costs, consumables, software, data licenses, cloud computing, and contributions to independent research remain eligible.

- The process of claiming now requires an additional information form that must be submitted to substantiate a claim alongside the advanced notification within the tax return.

Claimants must explain how a project:

- looked for an advance in the field

- had to overcome scientific or technological uncertainty

- tried to overcome the scientific or technological uncertainty

- could not be easily worked out by a professional in the field

The ‘merged scheme’ enables all companies to claim for subcontractors

Previously, large companies using the RDEC scheme could not claim for subcontractor costs, but in its legislation, HMRC outlined how SME rules now apply with the merged scheme, making it possible for all companies to claim for work they subcontract. There will, however, be a couple of limitations:

- With limited exceptions, only costs paid to UK-based subcontractors are eligible.

- The current SME limit will continue; claimants can only claim up to 65% of the costs paid to a subcontractor.

Rules applicable to Externally Provided Workers (EPWs)

- Again, with limited exception, this is restricted to EPWs based in the UK

- HMRC introduced a new constraint: UK EPWs must be subject to UK PAYE/NICs

- It appears from the announcement that the construction industry scheme and those inside IR35 arrangements will not be eligible for EPW arrangements.

R&D claimants will no longer be able to nominate a third-party payee for R&D tax credit payments, subject to limited exceptions. In addition, no new assignments of R&D tax credits will be possible from 22 November 2023, which means that, in most circumstances, payments of R&D tax reliefs will be paid directly to the company that claims the R&D.

Beware HMRC has significantly increased its compliance activities

To cut down on errors, fraud, and abuse of the scheme, HMRC has adopted a significantly more aggressive approach to compliance. With 25% of SME claims reportedly subject to ‘error and fraud’, just over £1bn of relief is being paid out to companies that HMRC believes shouldn’t be receiving it.

This means there is a greater chance of an enquiry being opened into an R&D claim. HMRC has 12 months from the filing date of your tax return to open an investigation; this can happen even if a credit/refund has already been paid.

How can we help?

These changes are still in the draft legislation stage, so we must wait until further legislation is announced but if you think we can help or would like to know more, please email our R&D Tax Team at rdtax@ifteam.co.uk

(Image Source: Shutterstock)

With thanks to our technology partner Ayming and Ben Craig, Associate Director, for their help with our iFD Community event and this blog.