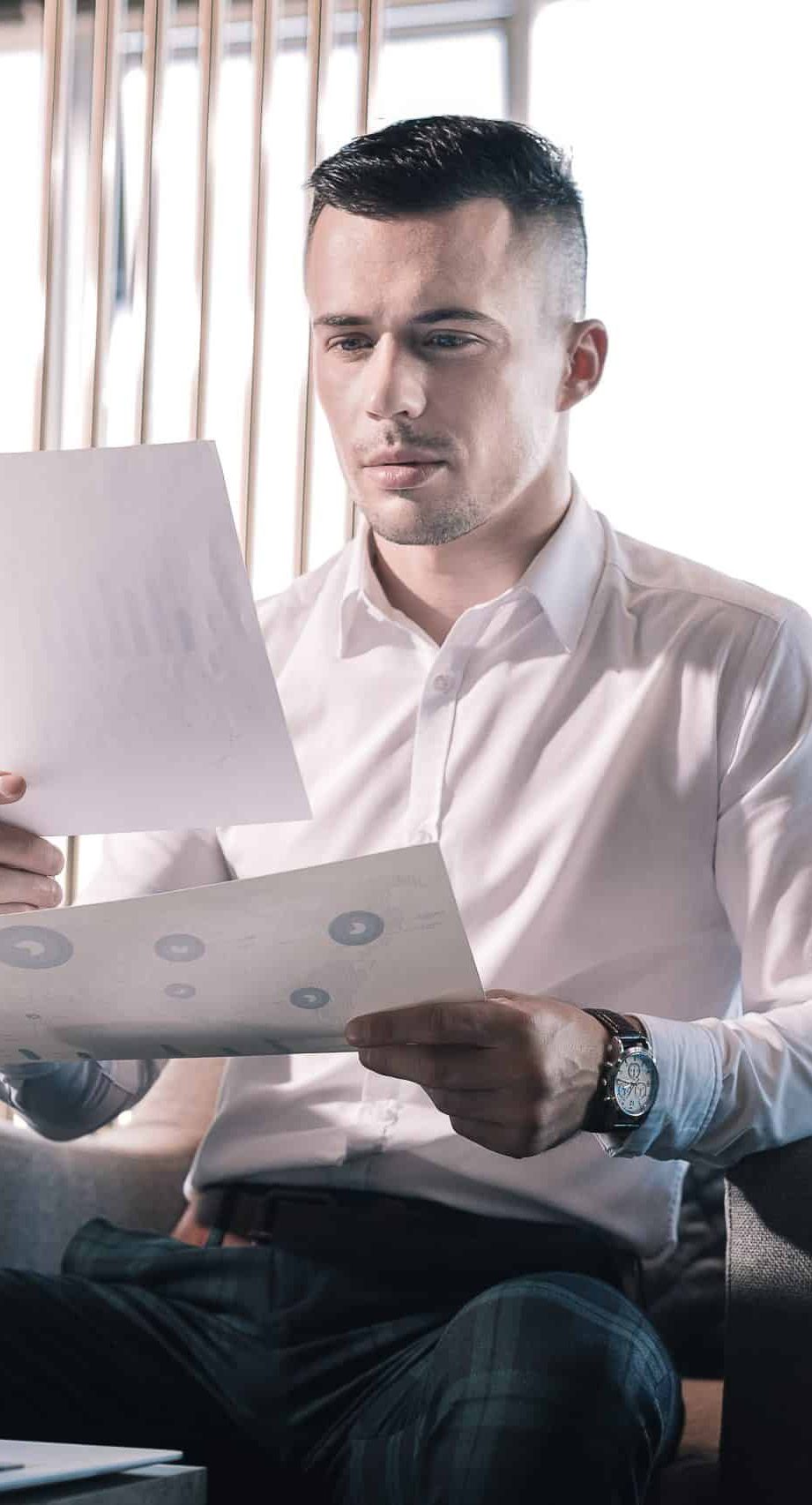

What Does the Service Look Like?

We will provide an experienced fractional CFO with the practical know-how to review your financial systems, processes and controls. Although every business is unique, our CFOs will follow a proven process:

Here’s what our service looks like:

Step 1 – In-depth Assessment: Conduct a thorough audit of your existing financial systems, processes, and controls to identify vulnerabilities, inefficiencies, and opportunities for improvement.

Step 2 – Introduce Best Practices: Introduce industry best practices and solutions that have been effective with similar businesses in your industry sector and ensure regulatory compliance

Step 3 – Advanced Technologies: Determine where investment in financial technologies can automate workflows, boost data accuracy and improve reporting capabilities.

Step 4 – Strengthen Risk Management: Identify financial and operational risks and implement appropriate controls to safeguard against potential financial losses.

Step 5 – Improve Reporting: Refine your reporting processes to ensure timely, accurate and actionable financial insights.

Step 6 – Identify Cost Savings: Uncover opportunities for cost reduction and operational efficiencies, such as renegotiating contracts and optimising inventory management.