Our Strategic Financial Advisory Service Discovery Day

Your CFO will use their knowledge to develop financial strategies that align with your company’s objectives, market position and growth potential. Our relationship begins with a Discovery Day. This day will enable your CFO to draw up your support roadmap, and this strategic review will typically cover the following areas:

1. Business and organisational structure

2. Company’s performance to date

3. SWOT analysis

4. Review of management accounts and cashflow position

5. Map out what ‘good looks like’ in one month, three months and six months.

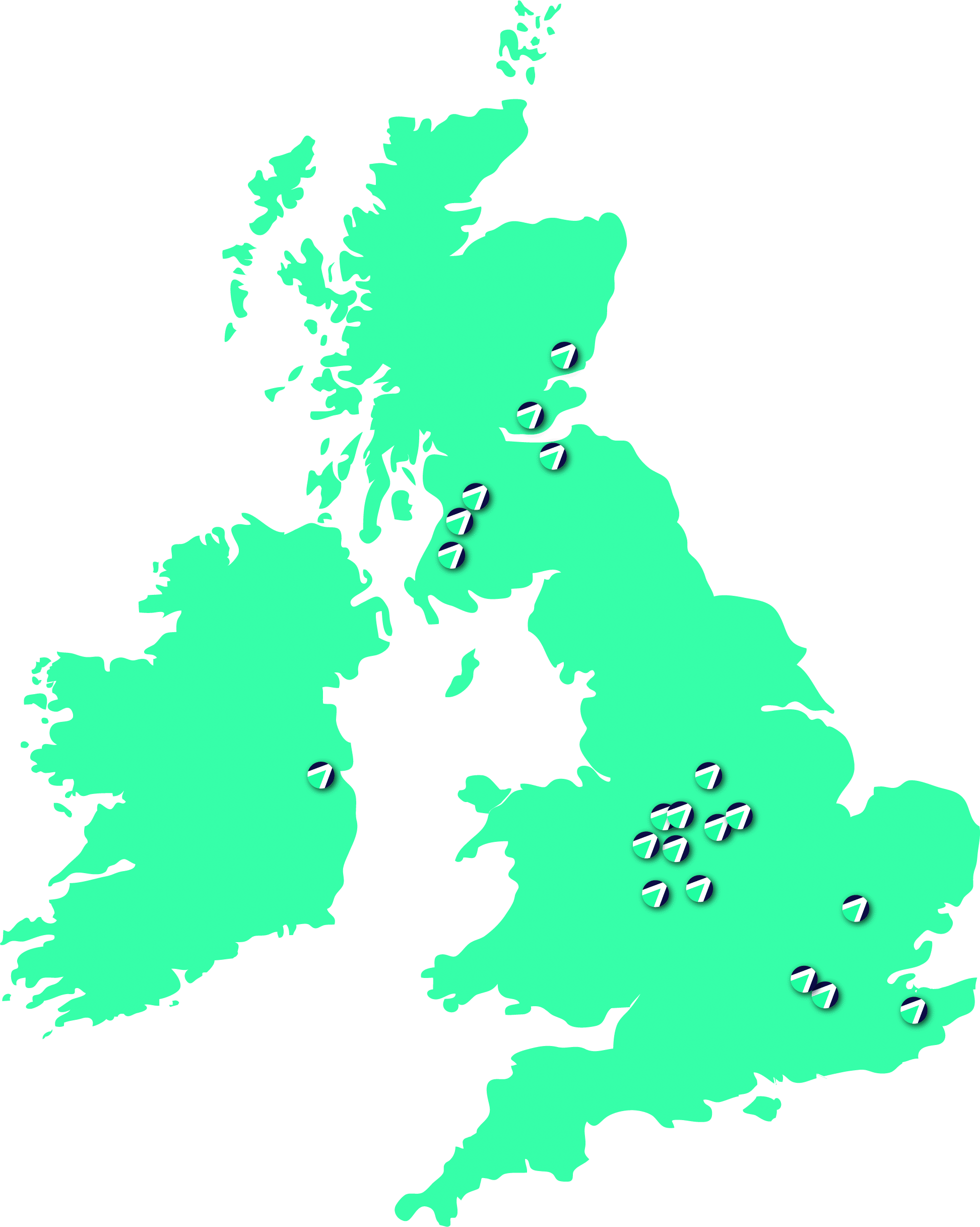

An iFD Fractional CFO comes with a network of contacts. This network can be invaluable for forming new partnerships, securing capital or sourcing top talent.

On completion of the Discovery Day, the Board and your Fractional CFO will clearly understand the path forward, with detailed insights into what needs to be done to optimise performance and achieve strategic goals.